Invoice Factoring Services

Factoring Is a Good Solution for Your

Are an established business or start-up selling to other companies.

Are unable to obtain traditional bank financing or increase an existing line of credit any further.

Send out invoices with payment terms of up to 120 days.

Benefits of Factoring with Tacoma Capital:

Lines up to $10M

Tacoma Capital has secure access to stable capital, enabling us to deliver on negotiated deals and adapt as your business needs evolve.

High Advance Rate

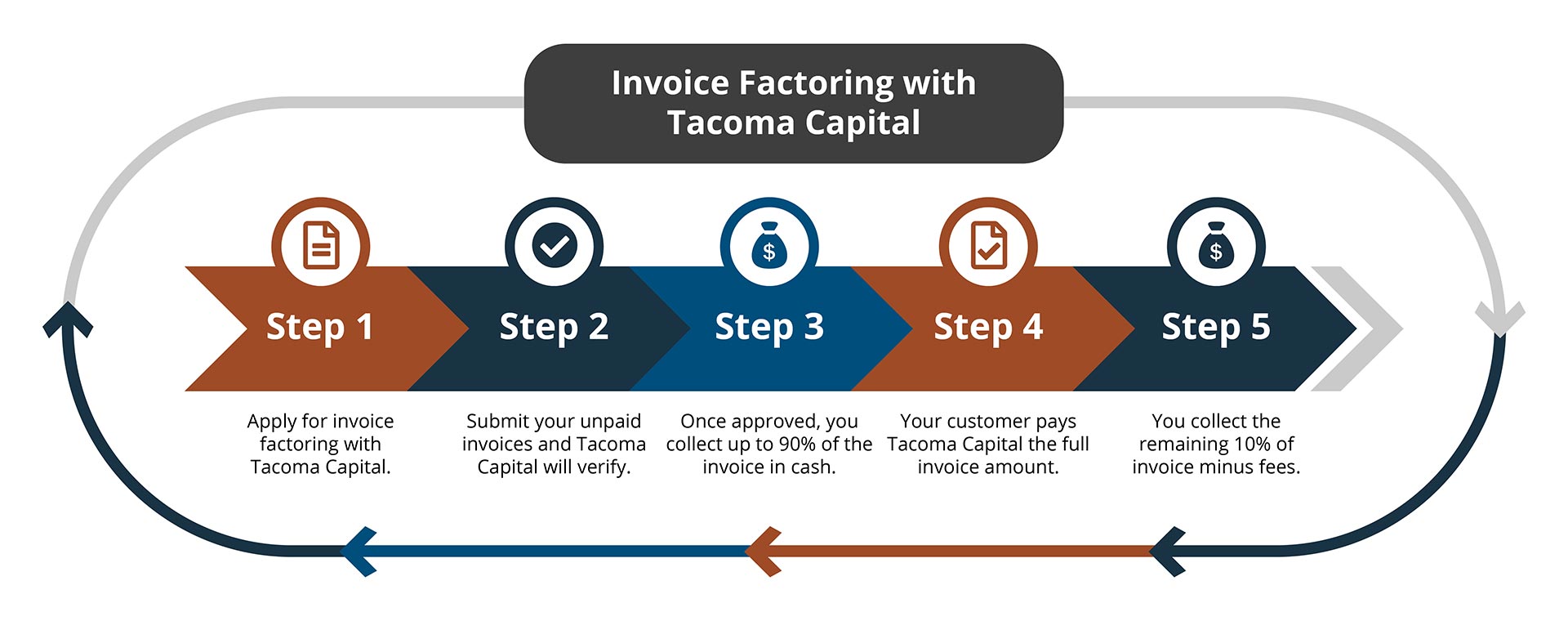

Help your business get more cash flow for expenses without the added debt. Receive up to 90% advance of your receivables.

Convenient Access

All Tacoma Capital clients have 24/7 access to their real-time status reports via our online account management system.

Flexible and Transparent Terms

Enjoy flexible terms and conditions as well and send out your invoices with payment terms of up to 120 days. Our invoice factoring process is simple and upfront—no hidden fees, tricks or gimmicks.

Personal Service

From applying to managing your account, our team is dedicated to your business. During the entire process, achieve peace of mind knowing you will always deal directly with the decision makers.

Fast Decisions

Get your business out of the red. Receive cash advance on your factored invoices within as little 24 hours.

How Does Invoice Factoring Work?

View FAQs

Get your cash flow back on track

Get Started Today

Benefits of Tacoma Capital

Our factoring services are transparent, fair, and simple. We offer our clients advances up to 90%, a simple flat rate with no hidden fees, along with expertise tailored to your needs.

Minimum Requirements

Tacoma Capital make it easy to get cash flow for your business. To start factoring your account receivables, you just need to be a business or startup that trades with other companies.

Request a Call Back

We understand sometimes a phone call is needed before getting down to business. Submit your contact details below and a member of our team will be in touch shortly. You may also email us at any time.

We will reach out to you during our office hours, M-F 8AM – 5PM. By submitting your information you are agreeing to our Privacy Policy and Terms of Use.